I have a Solo 401(k) at Vanguard for many years and it has served me well.

The small business portal, when you manage the account from the employer side, looks a bit dated but functions just fine. I’m able to quickly make contributions once a month (I’d have loved a way to automate it but alas that was not to be) and it recorded each transaction so I could just “repeat” them.

It turns out that Vanguard has sold the Individual 401(k), Multiple Participant SEP (Multi-SEP), and SIMPLE IRA Plans business to Ascensus, per their press release.

On Monday, I received a letter notifying me of the changes. I hadn’t even heard about it until getting the letter yesterday.

Personally, I find this a little annoying.

Like many people, I don’t like change, especially when it happens to something that is working relatively well.

But after digging in further, it’s not going to be a significant change (but it is still a little annoying).

Table of Contents

The Notice

Here are the three pages of the notice (click on them to expand into a much larger size):

Just some typical legalese as well as what to expect in the move. The only significant thing to note is that there is a blackout period from July 17th through the week of July 22nd, so potentially until July 26th. That’s a potentially two week period, which is a long time.

Who is Ascensus?

Ascensus is a financial services company that was founded in 1980 and headquartered in Dresher, PA. Vanguard is headquartered in Malvern, PA and the two companies are only 26.2 miles apart. The two aren’t affiliated in any way but it’s interesting that they’re located so closely to one another. Ascensus itself is owned by Stone Point Capital and GIC, Singapore’s sovereign wealth fund.

Ascensus manages a lot of retirement plans, including those of many states such as California’s program CalSavers.

Without seeing what goes on behind the scenes, I’d expect it to offer similar services to what Vanguard offers and I’d be as comfortable using Ascensus as I would Vanguard.

Which Accounts Are Being Sold?

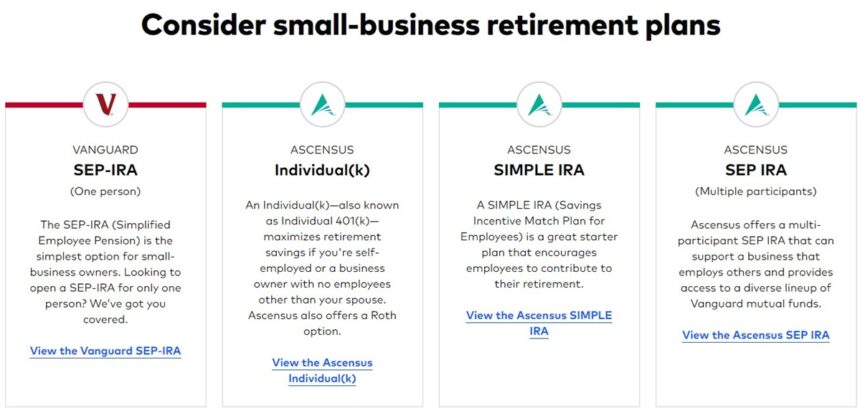

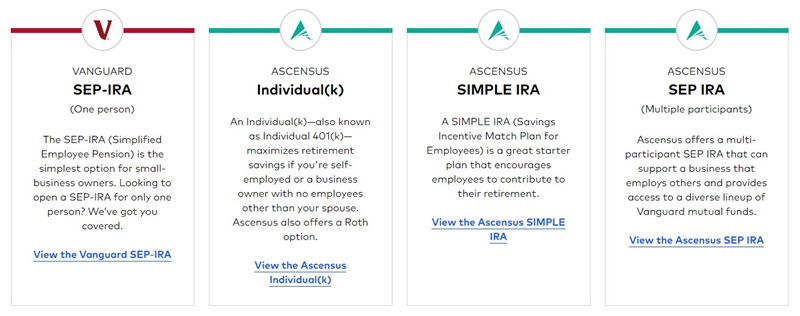

If you have an Individual 401(k), a SIMPLE IRA, or a SEP IRA, those are all moving over to Ascensus. The Vanguard website is already updated with the changes.

If you have an SEP-IRA, that’s remaining at Vanguard. Everything else is moving.

I have an Individual 401(k) so it was included in the move.

What Will Change?

Legally, what is happening is that Vanguard Fiduciary Trust Company is transferring sponsorship to Ascensus Trust Company. Then Vanguard Fiduciary Trust Company is resigning as the Trustee, effective July 22nd. If I want to move my 401(k), I have to do by July 12th otherwise I have to wait until the transfer is complete.

At first glance, the biggest change will be the fee structure.

For the account fee, Ascensus charges a $20 annual fee per participant. Vanguard charged $25 but would waive it if you had $5 million in assets or if you signed up for e-delivery of statements. It’s unclear if Ascensus offers this waiver option for e-delivery.

Next, Ascensus charges an annual account service fee of $20 per mutual fund for individual 401(k)s. Vanguard charges similar fees but it was waived if someone in the plan had at least $50,000 in assets.

My 401(k) plan charged $20 for each Vanguard mutual fund in each account but was waived. If you had a SIMPLE IRA, you actually get a small discount because Vanguard would charge you $25 per fund per account (if you didn’t have it waived). Ascensus only charges $20.

We keep our 401(k) holdings in just a handful of funds so this has a limited impact on us ($100 – $160 across two accounts) a year total across two participants. But it’s still annoying to have to pay a new fee out of the blue, even though it is a relatively small one.

What Will We Do?

For now, I’m going to leave the account with Ascensus.

As it turns out, it’s not trivial to move a 401(k) as an employer. There’s a lot of articles about rolling over a 401(k) as an employee, and as someone who has done it several times it’s quite easy, but moving the whole plan is a bit more involved and it’s not clear what advantages there are to moving it.

The clearest advantage is that I could avoid the new fees. Fidelity has a self-employed 401(k) that has no account fees and no minimums. I’d expect it to look and behave just the same as Vanguard’s and I may move it just to see what it’s like to use Fidelity.

As a long time user of Vanguard, I never had a reason to open up a new brokerage account… this might be a good reason.

Other Posts You May Enjoy:

What is an Interval Fund?

Interval funds are closed end funds that limited redemptions to set periods – this gives them the ability to invest in more complex instruments. But should you be investing in these types of funds?

What Happens When An AcreTrader Farm “Fails”

One of my first AcreTrader investments is running into some trouble and looking for a way out. See how AcreTrader handles it and what happens to a California almond farm.

Best Solo 401(k) Providers

A solo 401(k) is a retirement savings plan for self-employed people with no full-time employees. It allows them to save for retirement using pre-tax contributions while benefiting from the same tax advantages in regular 401(k) plans. Here are some of the top solo 401(k) providers available today.

Is Robinhood Gold Worth It?

Robinhood Gold is a $75 per year premium subscription service to Robinhood. It unlocks a few perks but are they worth the annual fee?

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools,, everything I use) is Personal Capital, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

He is also diversifying his investment portfolio by adding a little bit of real estate. But not rental homes, because he doesn’t want a second job, it’s diversified small investments in a few commercial properties and farms in Illinois, Louisiana, and California through AcreTrader.

Recently, he’s invested in a few pieces of art on Masterworks too.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.

Reader Interactions